Open a Chapter 11 Bankruptcy Case

Official Procedure -

References

| CM/ECF Menu |

Bankruptcy > Open a BKCase |

| Event |

None |

| Rules / Code / Resources |

Fed.R.Bankr.P. 1007; 1020; 2009; 2012; 2015; and 3016 11 U.S.C. §1101-1195 Local Rule |

02/14/2025- added screen shot to step one case opening

02/05/2021 - Updated new fields for Small Business and Subchapter V

| Date | Requestor | SR# | Description |

|---|---|---|---|

| 02/05/2021 | Jeand Dalicandro | 96899 | Updated for new fields for Small Business and Subchapter V |

| 05/01/2020 | Jean Dalicandro | 85085 | Created |

Chapter 11

The Small Business Reorganization Act (SBRA) of 2019 establishes a new subchapter V for chapter 11 to allow small business debtors to reorganize in Chapter 11 using a simplified and expedited process. The law was effective February 19, 2020.

- Filing Fee. If the fee is to be paid in installments, the debtor must be an individual and must file a signed application for court approval. Official Form 103A.

- Voluntary Petition (Official Form 101 or 201)

- Names and addresses of all creditors

- Statement of Social Security Number (Official Form 121). Required if the debtor is an

- individual.

- List of Creditors Holding the 20 Largest Unsecured Claims (Official Form 104 or 204)

- Certificate of Credit Counseling Counseling, filed with the petition or within 14 days. If applicable, the § 109(h)(3) certification or the §109(h)(4) request must be filed WITH the petition. Required if the debtor is an individual.

Links to Required Documents

- Voluntary Petition (B 101)

- Statement of Social Security Number (B121)

- Full Filing Fee or Application/Order to Pay Filing Fee in Installments (B103A)

Refer to Schedule of Fees for Filing Fee requirements.

For additional requirements, please review B2000, Required Lists, Schedules, Statements and Fees.

Before filing your case, please ensure the case number(s) of any bankruptcy cases pending or being filed by any spouse, partner or affiliate are listed on the appropriate page of the petition. See question #10 on page 3 of the Voluntary Petition for Individuals (Form 101) or page 2 of the Voluntary Petition for Non-Individuals(Form 201).

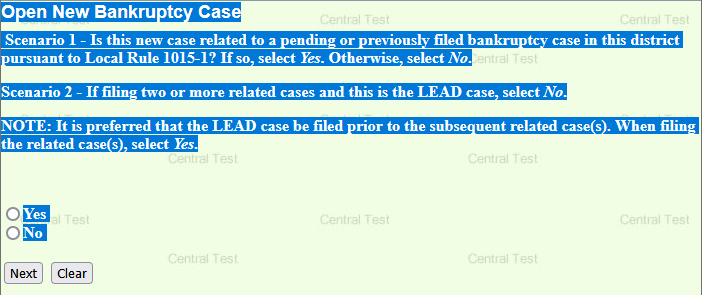

The following steps should be followed if following related cases:

- Open the lead case and run Judge/Trustee Assignment

- Open the remaining related cases. DO NOT run Judge/Trustee Assignment

- The court personnel will assign the judge on the lead case to the other related cases

The Certification of Relatedness is a required document at case opening and filed separately, Do Not include within the petition package.

If all cases are filed on the same day, the Certification of Relatedness is required on all cases.

If a case(s) is related to a previously - filed case, the Certification of Relatedness is ONLY required on the newly-filed case(s)/

A Statement of Social Security Number(s) (121)must be filed for all cases of individual debtors. In a joint case, one statement can be filed for both debtors.

Note: The Statement of Social Security is a required document at case opening and filed separately, Do Not include within the petition package.

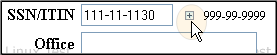

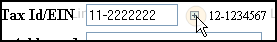

CM/ECF stores multiple SSN/ITINs and Tax ID/EINs for debtor and joint debtor. Up to five SSNs can be entered for debtor and joint debtor.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 required the Executive Office of the US Trustees (EOUST) to capture and store additional data for all individuals debtors filing a Chapter 7, 11, 12 and 13 case.

The source document where the information is taken from is the petition, schedules and Chapter 11 Statement - 122B .

Note: This document is filed separately, Do Not include within the petition package.

- The debtor's and/or joint debtor's street address must be reflected on the petition.

- If the debtor has a mailing address that is different from the street address, this address must also be reflected on the petition.

Step by Step Procedure

The following fields will default:

- Case type

- Date filed

- Select Chapter 11 from the drop down option

- Joint Petition defaults to n (no). Select y for (yes) for a joint petition

- Click Next

The Search for a debtor page will display. A search of the court's database will be conducted to determine if a record exists for the debtor.

A search should be conducted by the Social Security Number or Tax ID/EIN Number.

- Enter the Social Security or Tax ID Number

Name Field Option - Complete this search option only IF a Social Security Number or Tax ID/EIN Number is NOT provided.

Note: The proper format for entering data in CM/ECF is the use of Upper and lower letters. Do not use all capital letters or all lower case letters.

- Complete the Debtor's Name fields:

Individual Cases - complete the Last, First and Middle name fields (if applicable, Generation and/or Title)

Business Cases - enter the entire business name in the Last/Business name field

- Click Search

- No match found - "No person found" message will display. For instructions on how to complete, select No Person Found

- Match found - the party search results box will display with all possible matches. For instructions on how to complete, select Party Record Found

No Person Found

- Click Create new party

- Complete the debtor's name fields

Individual Cases - complete the Last, First and Middle name fields (if applicable, Generation and/or Title)

Business Cases - enter the entire business name in the Last/Business name field

CM/ECF stores multiple SSN/ITINs and Tax ID/EINs for debtor and joint debtor. Up to five SSNs can be entered for debtor and joint debtor.

A plus sign activates additional fields to enter multiple numbers for debtor and joint debtor

- Additional Social Security Numbers (SSN/ITIN) / Tax ID/EIN

If applicable, select theplus sign to enter additional SSN/ITIN or Tax ID/EIN

- Complete the address fields - begin with Address 1

If a mailing address is provided, the mailing address MUST be entered in CM/ECF

- Complete City, State and Zip Code fields

- Select County from the drop down option

If the street address and mailing address are provided on the petition, the county of the street address MUST be entered in CM/ECF

- Do Not complete the following fields: Office, County, Phone, Fax, E-mail, Party Text

- If applicable, click Alias to add alias name(s)

Party Record Found

The party search results page will display parties' name

- Review the list of names and select the name of the party that matches the petition

- Click Select name from list

The Debtor Information page will display

- If the address does not match, update the address

If the street address and mailing address are provided on the petition, the county of the street address MUST be entered in CM/ECF

- Do Not complete the following fields: Office, County, Phone, Fax, E-mail, Party Text

- If applicable, click Alias to add alias name(s)

- Click Submit

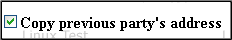

- Joint Filing, repeat step 6 and 7

If the joint debtor does not reside at the same address of the debtor, uncheck theCopy previous party's address box and enter the address information for the joint debtor.

The Divisional Office page will display - The divisional office is based on the county selection. Either Eastern or Western will display.

- Click Next

The Statistical Data page will display.

If the debtor/joint debtor previously filed, the following message will display -It appears that these debtors filed cases

- Complete the Statistical Data fields:

Prior filing within last 8 years

- Based on the SSN/ITIN or Tax ID/EIN entered CM/ECF will default to no for no prior filings exist or yes if prior filing exist

If prior filings exist, please remember to include all prior bankruptcy cases on page 2 of the Voluntary Petition

Fee status

- Defaults to Paid

If the filing fee is not being paid in full, select one of the following options from the Fee status option:

Installment - select this option when the filing fee is being paid in installments (Chapter 11 individual cases only)

Nature of debt

- Select business, consumer or other

Asset notice

- Defaults to the . Do Not make any changes to this field

Estimated number of creditors

- Click drop down arrow and make selection

Estimated assets

- Click drop down arrow and make selection

Estimated liabilities

- Click drop down arrow and make selection

Small business option

- Defaults to N for No. Select N or Y

SubChapter V

- Check box If Subchapter V

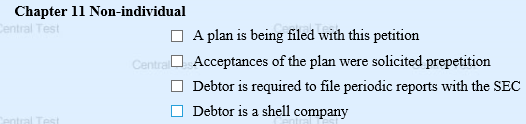

Chapter 11 Non - individual option will display, if applicable select the appropriate radio button that applies

Type of debtor

- Defaults to Individual. If applicable, select radio button for type of debtor

Nature of business

Select , if applicable.

Special categories

Select, if applicable

NAICS code

Select, if applicable

- Click Next to continue

The following message will appear:

REMINDER:The following documents are to be FILED separately from the Petition. Please Do Not include within the Petition:

Statement of Social Security Number (121) - Required if debtor is an individual.

Statement of Current Monthly Income (122B) Required if debtor is an individual.

Certificate of Credit Counseling - Required if debtor is an individual.

- Click Next

TheSummary of Assets and Liabilities and Certain Statistical Information page will display for individuals.

This page should be completed for individual debtors filing a chapter 11

Data from the Summary of Assets and Liabilities and Certain Statistical Information (Form 106Sum), must be recorded on this page. Record totals only from schedules A/B, D, E/F, I, J, Form 122B and the Total Nondischargeable Debt (Official Form 106Sum, 9g).

If the Summary of Assets and Liabilities and Certain Statistical Information (Form 106Sum) is not filed with the petition, leave all fields blank

- Click Next

The PDF Document selection screen will display.

- Click Next

The fee amount will display.

If you selected Installment for fee status in step 10, please indicate fee amount paid with petition and file Pay Filing Fee In Installment from the MOTION category.

- Click Next to continue

-

The Final Text screen will display

- Click Next to submit

Judge/Trustee Assignment

- Select one of the two options:

- Run Judge/Trustee - this option will assign the judge, trustee and 341 meeting date/time/location

- After the assignment is complete, click the X in the upper right corner to close the window

- Continue Filing - this option allows you to continue filing cases or documents without assigning the judge, trustee and 341 meeting date/time/location.

- If you select this option, please remember to select Bankruptcy>Run Judge/Trustee Assignment to assign the judge, trustee and 341 meeting date/time/location for all cases filed

Electronic Payment

- Select one of the two options:

- Pay Now - this option allows you to make the payment and the end of the filing process

- Continue Filing - this option allows you to continue filing cases or documents and paying the fee at the end of your filings.

- If you select this option, please remember to select Utilities>Internet Payments Due and process all outstanding payments due

It is the verification that the filing has been sent electronically to the court.

Copies of this notice and the document filed are emailed to all participants who receive electronic notification in the case. You have a period of 15 days for a one timefree look at the document filed.

Complete the following additional filings that apply to your case

-

Upload List of Creditors File (required for all cases)

-

Related Cases - Certification of Relatedness

-

Statement of Current Monthly Income

Statement of Current Monthly Income

- Chapter 11 - 122B

-

Certificate of Credit Counseling

Certificate of Credit Counseling

-

Required if debtor is an individual

-

-

Chapter 11 Plan - Only IF you indicated that a Plan was included with the opening of the chapter 11 case - refer to step 10